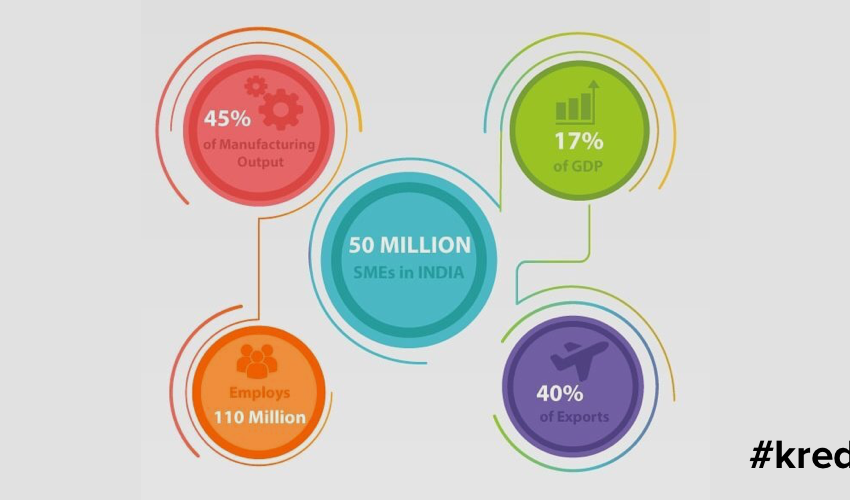

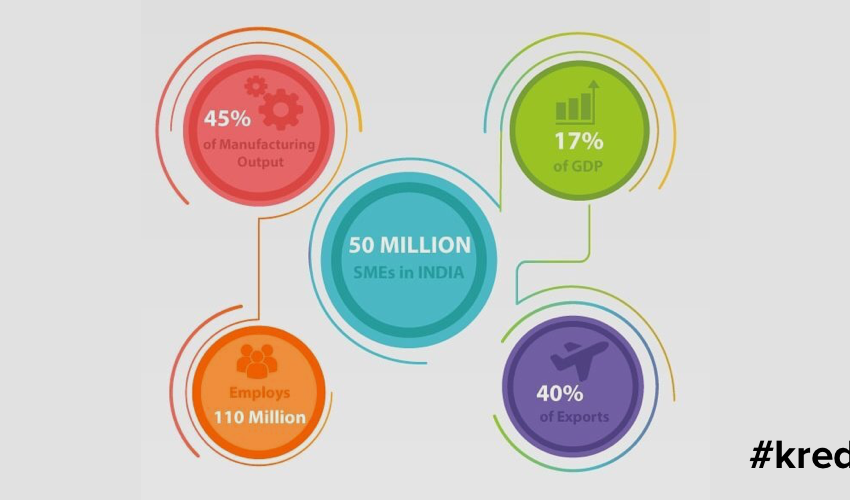

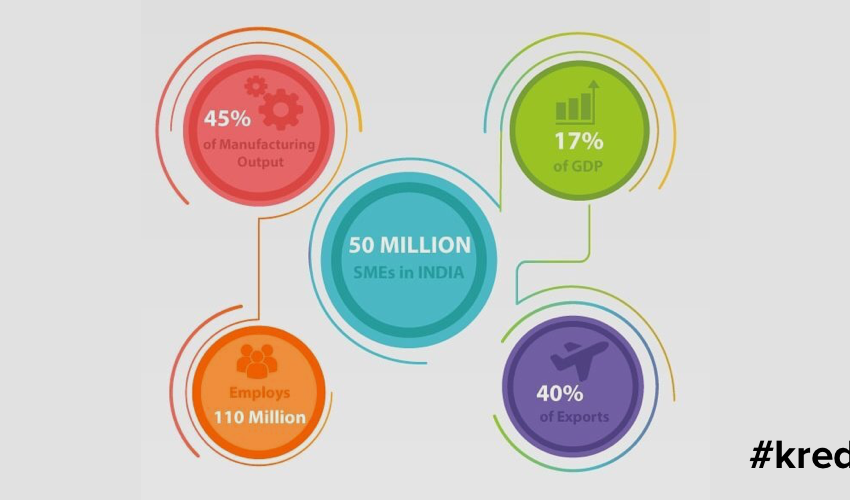

The Medium and Small business sector is the backbone of any great economy and India is no different. They are the silent engines of economic growth. They will have to serve as the building blocks of growth if India has to achieve its place under the sun of becoming an established Economic Power in the world.

Financing is the biggest impediment to the success of these MSMEs. Access to finance is constrained mainly due to the unwillingness of the formal sector (banks, investors) to lend given the perceived high risk associated with them. This perception comes from the fact that most of these MSMEs do not have clear financial records nor any collateral to secure the lending. Less than 1/4th of the financing needs of SMEs are met by the formal banking sector.

Unavailability of credit facility causes these small businesses to contribute only around 17% to the India GDP even after employing around 40% of the total workforce. In contrast, small businesses in the developed economies contribute almost 40% to their countries GDP. Appropriate financing could help these businesses to be truly successful.

We, at KredX, are trying to solve this problem by providing working capital solutions to these MSMEs. KredX uses an amalgamation of technology and sophisticated credit modelling methodologies to identify strong businesses and provide an invoice financing facility. KredX – India’s Premier Invoice Discounting Marketplace helps these small businesses to encash the money tied up in unpaid invoices drawn of established corporates.

Salarpuria Softzone, Ground floor, Wing 'A', Tower A, Dr Puneeth Rajkumar Rd, Bellandur, Bengaluru, Karnataka 560103

+1 212-602-9641

info@example.com